Blog

By: Tobias Salinger October 13, 2021, 10:55 a.m. ED T2 Min Read

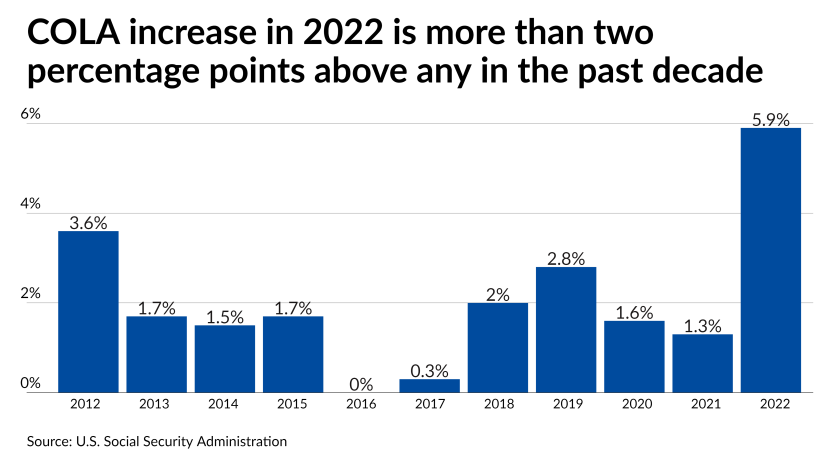

More than 64 million Social Security beneficiaries will get some measure of relief from inflation next year in the form of the highest cost-of-living increase in 39 years.

Benefits will rise by 5.9% in 2022 — an increase of $92 per month in average benefits for retired workers or $154 for a couple with both spouses receiving them — due to the sharp increase in the Consumer Price Index over the past 12 months, the Social Security Administration said on Oct. 13. We believe the widely expected bump in benefits likely will not keep up with Medicare premiums and most likely won’t change the 21% cuts projected in 2034 without Congressional action.

Full Article Here: https://www.financial-planning.com/news/social-security-cola-jumps-in-2022

The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of [FA NAME] and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice.

This information was developed by Tobias Salinger, an independent third party. The opinions of Tobias Salinger and FinancialPlanning.com are independent from and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice.

Making Money is Easier than Keeping it!

Article by Lynn Phillips-Gaines

Published on August 15, 2021, in Starkville Daily News

We get multiple inquires a week from people looking for where to put their cash. People who never would have considered taking on risks with this money look for any place they can go for yield. Savers are considering bond funds, which lose principal when interest rates increase, or annuities with surrender fees, which tie up your money and don’t necessarily guarantee the interest rate beyond your first years. We are not saying these investments don’t have a purpose; they do, but not for your emergency reserves.

In The Psychology of Money, Morgan Housel says, “If I had to summarize money success in a single word, it would be ‘survival.’ Investing is not necessarily about making good decisions. It’s about consistently not screwing up”. And this is where the entire art of asset-allocation comes into play—giving you the comfort to weather hard times with investments. An appropriate asset allocation can help keep you from making a catastrophic mistake.

See below for the full article that was published in the Starkville Daily News.

Investor Psychology

Article by Lynn Phillips-Gaines

(Published on July 4, 2021, in Starkville Daily News)

When I hear that one of the most conservative CPAs in the Golden Triangle is making stock recommendations to his buddies, I know the market is flying high. When skittish investors are stock experts, it is one of the telltale signs of a possible market peak.

What is old is new again. The issues which we had to plan around for clients in the 1980s are circling back. The three challenges impacting financial independence are increased taxation, increased inflation, and the reluctance to get serious about a bonified investment plan.

It is hard to take these issues seriously unless you have lived through these times. According to Morgan Housel in The Psychology of Money, your investment behavior develops through your experiences during adolescence or early adulthood.

Interestingly, people from different generations, born into other economies, different families in different geographical regions, learn very different lessons about investing. And, behavior psychology tells us that what you experience is more compelling than what you learn second-hand. Your personal experiences with money are tiny relative to what happens in the world of finance; however, part of what happens in the world will constitute 80% of how you think the world works. Thus, “experts” differ widely in explaining what is happening in the world of finance.

See below for the full article that was published in the Starkville Daily News.

The retirement quandary: How to avoid dying with a large pot of money for your “daughter-in-law to spend.” After a lifetime of savings most clients wish to enjoy the fruits of their discipline. A retirement spending plan which gives you financial reassurance doesn’t simpy happen; you must have a strategy.

See below for the full article recently published in the Starkville Daily News.