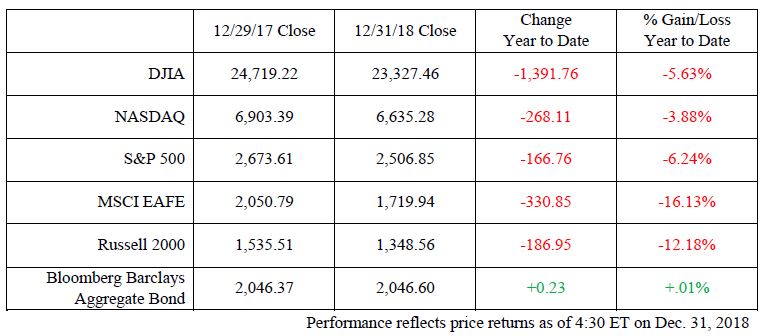

While the global equity markets enjoyed one of their best years in 2017, 2018 offered a different story, bookended by early- and late-year volatility. The last week in December, for example, saw stocks attempt a rebound from the edge of bear market territory. According to Bloomberg data, it was the first time since May 2010 that the S&P 500 had posted such a large reversal.

This year told a tale of trade conflicts with China, the intensifying Mueller investigation, geopolitical tensions, government shutdowns over the budget and the possibility of slower economic growth amid higher interest rates. While we’ve seen some progress on trade talks with China, there are still contentious issues to be ironed out, explains Washington Policy Analyst Ed Mills.

This is the first year in nearly a decade in which most major asset classes will end in negative territory, notes Peter Greenberger, director, Mutual Fund & 529 Plan Product Management. A particularly turbulent December brought almost daily gyrations, with the three major domestic indices ping-ponging between gains and losses.

Here is a look at what’s happening in the economy and capital markets, as well as key factors we are watching:

Economy

- Recent economic data reports have remained consistent with relatively strong growth and contained inflation, according to Raymond James Chief Economist Scott Brown. Growth is expected to moderate in 2019, and there are some potential headwinds, including trade policy, slowing global growth, Brexit, Italy and the Mueller investigation.

- The Federal Reserve (Fed) raised short-term interest rates four times in 2018. Future policy moves will remain data-dependent, but the pace of rate increases is expected to slow in 2019.

Equities

- The broad market S&P 500 is approaching bear market territory as defined by a 20% decline.

- However, Mike Gibbs, managing director of Equity Portfolio & Technical Strategy, believes economic growth, the jobs market, leading indicators and corporate profits all support non-recessionary conditions.

- This year, earnings are set to grow by a very strong 22.2%, and Gibbs expects to see 5-6% growth in 2019.

Fixed income

- It’s likely that the bond market will continue to react to market conditions, and investors can expect some volatility in the near future. For November, the yield went from 3.13% to 2.99% and was hovering around 2.81% toward the end of the year, points out Doug Drabik, senior fixed income strategist.

- The 2- to 10-year Treasury spread has shown little movement. But Drabik notes that the 1-to-5-year part of the Treasury curve is extremely flat to slightly inverted. Of greater significance is the flattening of the 3-month bill to 10-year Treasury, in his view.

- The volatility can be largely attributed to the Fed’s short-term rate hikes as well as the flight-to-quality as investors move from equities into bonds.

- During times of greater volatility, adhering to a long-term plan can be helpful. Laddered maturity investing across the yield curve may provide the advantages of optimizing long-term income while mitigating interest rate risk.

International

- Markets outside the U.S. also struggled in December, although, on average, not to the same degree. This partially reflected poorer performances earlier in the year, but also reflected some further signs that the dollar may have peaked against its other major currency peers, explains European Strategist Chris Bailey. This currency shift could influence the direction of future investment flows as many investors cut their allocations to emerging markets and Europe in the past couple of years due to the strength of the dollar.

- In the U.K., the Brexit debate remains complicated and still has multiple end scenarios, but more recent conversations have again focused on the need to find a compromise deal. Meanwhile in the Eurozone, an agreement was reached between the European Commission and the Italian government over the latter’s budget for 2019. This enshrined a greater use of fiscal policy measures, a point also apparent in new policies introduced by President Macron of France that appear to have helped quell recent significant public demonstrations in the country.

- Chinese policymakers appear more focused on building on the better tone around global trade negotiations by restarting purchasing of important commodities such as soybeans (from the U.S.) as well as seemingly committing themselves to more reform measures such as opening up more product markets to more competition. There were also signs of new fiscal policy stimulus measures in China as well as elsewhere in the region in Japan.

Bottom line

- If we were to slip into a bear market right now, Gibbs expects it to be non-recessionary. Keep in mind that non-recessionary bear markets have typically rebounded to new highs twice as quickly as recessionary bear markets. Investors should remain steadfast in the face of headlines that may cause market gyrations. Investing is a long-term endeavor and should be viewed as such, Greenberger notes.

Investing involves risk, and investors may incur a profit or a loss. All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates, Inc., and are subject to change. Past performance is not an indication of future results and there is no assurance that any of the forecasts mentioned will occur. The process of rebalancing may result in tax consequences. Economic and market conditions are subject to change. The Dow Jones Industrial Average is an unmanaged index of 30 widely held stocks. The NASDAQ Composite Index is an unmanaged index of all common stocks listed on the NASDAQ National Stock Market. The S&P 500 is an unmanaged index of 500 widely held stocks. The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. The Russell 2000 is an unmanaged index of small cap securities. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. An investment cannot be made in these indexes. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Small and mid-cap securities generally involve greater risks. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification. The performance noted does not include fees or charges, which would reduce an investor’s returns. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Debt securities are subject to credit risk. A downgrade in an issuer’s credit rating or other adverse news about an issuer can reduce the market value of that issuer’s securities. When interest rates rise, the market value of these bonds will decline, and vice versa. U.S. Treasury securities are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. The yield curve is a graphic depiction of the relationship between the yield on bonds of the same credit quality but different maturities. Chris Bailey is with Raymond James Euro Equities, an affiliate of Raymond James & Associates, and Raymond James Financial Services. Material prepared by Raymond James for use by its advisors.

Securities offered through Raymond James Financial Services, Inc., member FINRA/SIPC.

© 2019 Raymond James Financial Services, Inc., member FINRA/SIPC. Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc.

Raymond James Financial Services does not accept orders and/or instructions regarding your account by email, voice mail, fax or any alternate method. Transactional details do not supersede normal trade confirmations or statements. Email sent through the Internet is not secure or confidential.

Raymond James Financial Services reserves the right to monitor all email. Any information provided in this email has been prepared from sources believed to be reliable, but is not guaranteed by Raymond James Financial Services and is not a complete summary or statement of all available data necessary for making an investment decision. Any information provided is for informational purposes only and does not constitute a recommendation. Raymond James Financial Services and its employees may own options, rights or warrants to purchase any of the securities mentioned in this email. This email is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please contact the sender immediately and delete the material from your computer.