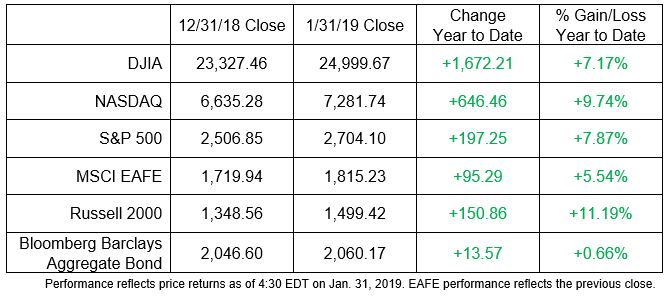

After a year of mixed market signals, domestic equity markets started 2019 off fairly strong based on fourth-quarter earnings and lower unemployment figures. Some of the former haven’t been particularly impressive, but investors seem to be in a forgiving mood after a rough December. The Federal Reserve’s “patient” stance on future interest-rate moves buoyed markets even further after its January 30 meeting. The target range for the federal funds rate remains at 2.25% to 2.5%. Equity markets also seem to be ignoring the effects of the partial government shutdown, with all major domestic indices ending January firmly in positive territory.

Here is a look at other happenings in the economy and capital markets, as well as key factors we are watching:

Economy

- The partial government shutdown is expected to have subtracted a few tenths of a percentage point from first-quarter growth, according to Raymond James Chief Economist Scott Brown. A number of important economic data reports have been delayed due to the shutdown, but we should see them released over the next several weeks.

- Congressional leaders agreed to fund the government through February 15. While another shutdown is possible, we aren’t likely to see a repeat, Brown noted.

- The near-term economic outlook remains positive, based largely on expectations for robust consumer spending growth (which accounts for 68% of gross domestic product). Meanwhile, Brown sees a mixed economic outlook longer term. Most likely, consumer spending will carry us through in 2019, but there is some potential for a more substantial weakening in business investment, he noted.

- Federal Reserve policymakers chose not to raise rates at their January meeting. And the odds of further rate hikes in 2019 have decreased dramatically, according to Joey Madere, senior portfolio analyst, Equity Portfolio & Technical Strategy.

- There have been some positive signals over the past month on U.S.-China trade negotiations, but there remains a long way to go to reach a potential trade deal by March, Madere said.

Equities

- The S&P 500 has rallied sharply from Christmas Eve lows over the past month. Investors seemed to have largely shrugged off the shutdown of the government. Higher volatility investments are seeing the largest boost, seemingly bouncing from last month’s bottom, noted Nick Lacy, chief portfolio strategist for Raymond James Asset Management Services.

- Meanwhile, the fourth-quarter earnings season is in full swing. S&P 500 earnings are now expected to grow by 12.1% for the full quarter on sales growth of 6.3%, explained Joey Madere, senior portfolio analyst, Equity Portfolio & Technical Strategy. The average S&P 500 company has moved 1.45% higher on its earnings report.

- On the energy front, oil prices have had a healthy bounce in the first month of 2019 after falling nearly 30% during the fourth quarter, according to Pavel Molchanov, senior vice president of equity research.

- While the late 2018 selloff showed that sentiment and momentum matter more in the short run than fundamentals, Molchanov still believes fundamentals and the physical oil market will ultimately prevail – which would be bullish for oil.

- Molchanov predicts sizable 2019/2020 drawdowns in global petroleum inventories and sees potential upside to oil prices of approximately 50% over the next 12 to 18 months.

Fixed income

- The Treasury market was extremely flat for January with virtually no change to the 1-, 5-, 7- and 10-year bonds. The 2- and 3-year Treasuries had the greatest move, falling slightly in price to net six basis points more yield, noted Doug Drabik, senior fixed income strategist.

- While few things could impact a significant upward move in rates, certain events have the potential to move markets, amplify a flight to quality and hinder economic growth, including: results of the Mueller investigation, an even more complicated Brexit, continued trade wars with China and/or an Italian bank implosion, Drabik said.

- Municipal demand remains strong on the short to intermediate part of the municipal curve. Yields inside of 15-year maturities were down slightly, while yields greater than 15 years are somewhat higher. The “sweet” part of the municipal curve has pushed out to around 13 to 19 years where 80% to 90% of the entire curve’s yield can be obtained, he added.

International

- In a role reversal, January was generally positive for international financial markets despite the difficulties of the fourth quarter and a slowing global economy, explains European Strategist Chris Bailey.

- Official Chinese economic statistics show signs of a slowdown, but not to levels that would put the Chinese government’s targets at risk, Bailey noted. This may be due to increasing stimulus measures, including extra government spending and loosening monetary policy.

- The European Central Bank – which had formally ended its quantitative easing expansion policy last year – signaled to the financial markets that its policy positioning will remain very loose for the foreseeable future.

- In the U.K., the Brexit question continues to dominate local political and economic debates. With around two months to go until the deadline for the U.K. to leave the European Union, precise clarity on what will happen does not yet exist. However rising agitation from the business community about the costs of a ‘no-deal’ Brexit appears to be having an impact. Certainly the upward performance of the British pound in recent weeks suggests saner heads are starting to prevail, Bailey added.

Bottom line

- The S&P 500 P/E multiple is currently in line with the 65-year average, which, in Madere’s view, makes the risk/reward balance favorable over the next 12 months. Short-term influences may come into play, including the continuing trade negotiations and budget talks in D.C.

- Any resulting consolidation (after January’s sharp rally) could be seen as a buying opportunity, Madere suggested.

- We encourage you to take a long-term view of your financial plan and remain focused on opportunistically adding higher quality, fundamentally sound stocks that complement your portfolio.

Investing involves risk, and investors may incur a profit or a loss. All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates, Inc., and are subject to change. Past performance is not an indication of future results and there is no assurance that any of the forecasts mentioned will occur. The process of rebalancing may result in tax consequences. Economic and market conditions are subject to change. The Dow Jones Industrial Average is an unmanaged index of 30 widely held stocks. The NASDAQ Composite Index is an unmanaged index of all common stocks listed on the NASDAQ National Stock Market. The S&P 500 is an unmanaged index of 500 widely held stocks. The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. The Russell 2000 is an unmanaged index of small cap securities. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. An investment cannot be made in these indexes. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Small and mid-cap securities generally involve greater risks. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification. The performance noted does not include fees or charges, which would reduce an investor’s returns. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Debt securities are subject to credit risk. A downgrade in an issuer’s credit rating or other adverse news about an issuer can reduce the market value of that issuer’s securities. When interest rates rise, the market value of these bonds will decline, and vice versa. U.S. Treasury securities are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. Interest on municipal bonds is generally exempt from federal income tax; however, it may be subject to the federal alternative minimum tax, state or local taxes. The yield curve is a graphic depiction of the relationship between the yield on bonds of the same credit quality but different maturities. Chris Bailey is with Raymond James Euro Equities, an affiliate of Raymond James & Associates, and Raymond James Financial Services. Material prepared by Raymond James for use by its advisors.

Securities offered through Raymond James Financial Services, Inc., member FINRA/SIPC.

© 2019 Raymond James Financial Services, Inc., member FINRA/SIPC. Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc.

Raymond James Financial Services does not accept orders and/or instructions regarding your account by email, voice mail, fax or any alternate method. Transactional details do not supersede normal trade confirmations or statements. Email sent through the Internet is not secure or confidential.

Raymond James Financial Services reserves the right to monitor all email. Any information provided in this email has been prepared from sources believed to be reliable, but is not guaranteed by Raymond James Financial Services and is not a complete summary or statement of all available data necessary for making an investment decision. Any information provided is for informational purposes only and does not constitute a recommendation. Raymond James

Financial Services and its employees may own options, rights or warrants to purchase any of the securities mentioned in this email. This email is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please contact the sender immediately and delete the material from your computer.