The threat of further tariffs is diminished in the near term following the much anticipated meeting of President Trump and Chinese President Xi Jinping on Saturday at the Group of 20 (G20) summit in Osaka, Japan, reports Washington Policy Analyst Ed Mills. The pair made commitments to restart trade negotiations, resume certain shipments to Huawei, and for China to purchase a to-be-defined amount of U.S. agricultural products. Mills thinks the immediate market reaction will be positive. However, it’s unclear what the long-term implications may be, and no timeline was set for the next round of talks.

On the domestic front, odds of a downturn have increased in Raymond James Chief Economist Scott Brown’s view, but he still believes a recession isn’t likely within the next 12 months. However, he notes the inverted yield curve does signal an expectation that short-term interest rates will fall. For now, the Federal Open Market Committee has opted to leave short-term interest rates as is after its June policy meeting, as expected. He adds that most Fed officials seem to agree that the case for a rate cut this year has strengthened.

Following the first round of presidential debates by the Democratic candidates, several leading topics emerged – including health care policy, inequity in the tax code, antitrust scrutiny, climate issues and geopolitical challenges – which are likely to make headlines over the next year and potentially impact the market, says Mills. He will be watching for ideological differences between the candidates to gauge the direction of various policy proposals and help assess market risk in the event of a presidential changeover post-2020.

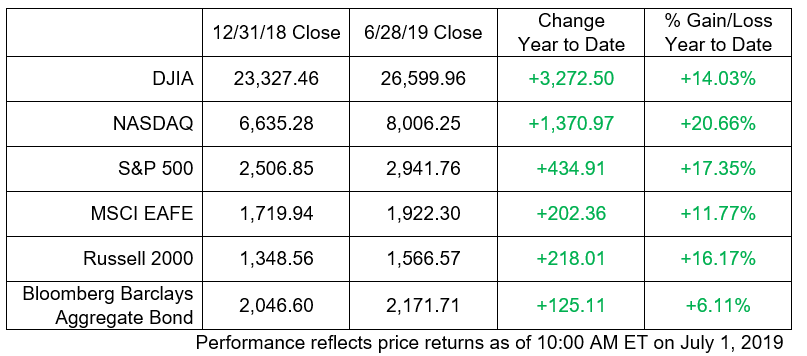

According to Bloomberg, the S&P 500 closed on Friday up 6.9% for the month of June – its best performance since January. The month also ended positively for the Dow Jones Industrial Average (+7.19%), NASDAQ (+7.42%) and the Russell 2000 Index (+6.9%).

Here is a look at what’s happening in the markets both here and abroad, as well as key factors we are watching:

Economy

- According to Brown, May’s increase in tariffs on Chinese goods weighed on the U.S. economy, with factory output in decline, alongside a slowing global economy.

- Following its decision not to change short-term interest rates, he says the FOMC promised to closely monitor the economic outlook and “act as appropriate to sustain the expansion, with a strong labor market and inflation near its symmetric 2% objective.”

- In his post-FOMC press conference, Fed Chair Powell noted concerns about low inflation and a reemergence of cross-currents – principally trade policy uncertainty and worries about global growth – but indicated that officials wanted more information and to see whether the cross-currents might recede.

- Investors are anticipating a 25-basis-point cut in the federal funds target range at the July policy meeting.

Equities

- The performance of the U.S. equity market relative to the rest of the world has continued its positive trend, reports Joey Madere, senior portfolio analyst, Equity Portfolio & Technical Strategy. China’s equity market, as well as U.S. companies with outsized exposure to China, was also outperforming in the several days leading up to trade talks this past weekend. This positive momentum is helping to make up for underperformance in May, and is likely to continue in the short term on optimism following the G20 summit.

- Madere points out that there has been plenty of sector rotation taking place beneath the surface. The stall in interest rates has led to some profit-taking among high-yield utilities and REITs. The technology sector is on the verge of all-time highs, and health care’s trend drastically improved in June.

- The slow growth, low interest rate and narrow yield curve backdrop continues to generally favor growth over value. Madere continues to favor large-cap companies, as technical trends for small caps remain stubbornly weak.

Fixed income

- Corporate and municipal bonds have rallied along with Treasuries, although municipal and corporate curves remain positively sloped.

- Despite many countries’ efforts to stimulate their economies with accommodative monetary policies, Senior Fixed Income Strategist Doug Drabik reports that the Bloomberg Barclays Global Aggregate Negative Yielding Debt Index reflects that the world’s negative debt has risen by 30% this month to a record $13 trillion –which he feels is a clear indication of an unhealthy global economy. The negative global rates make the U.S. bond market more attractive and put a cap on our bond yields.

International

- According to European Strategist Chris Bailey, global markets typically made forward progress during June, despite major global fund management surveys showing feelings of caution among investors.

- While uncertainties continue in European politics, equity markets were buoyed this month by hopes of a trade breakthrough at the G20 summit and further central bank stimulus, he explains. During June, both the European Central Bank and the Bank of Japan talked about the potential for further stimulus.

- Bailey says Chinese economic data continued to slow this month, although not enough to negatively impact markets.

Bottom line

- Brown thinks the risk of a recession in the next 12 months is low.

- We continue to be constructive on U.S. equities, but ultimately feel that a diversified asset allocation is crucial to helping investors ensure their portfolios stay balanced over time and in various market conditions.

Investing involves risk, and investors may incur a profit or a loss. All expressions of opinion reflect the judgment of the Research Department of Raymond James & Associates, Inc., and are subject to change. Past performance is not an indication of future results and there is no assurance that any of the forecasts mentioned will occur. The process of rebalancing may result in tax consequences. Economic and market conditions are subject to change. The Dow Jones Industrial Average is an unmanaged index of 30 widely held stocks. The NASDAQ Composite Index is an unmanaged index of all common stocks listed on the NASDAQ National Stock Market. The S&P 500 is an unmanaged index of 500 widely held stocks. The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. The Russell 2000 is an unmanaged index of small cap securities. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The Purchasing Managers Index (PMI) is a measure of the prevailing direction of economic trends in manufacturing. An investment cannot be made in these indexes. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Small and mid-cap securities generally involve greater risks. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification. The performance noted does not include fees or charges, which would reduce an investor’s returns. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Debt securities are subject to credit risk. A downgrade in an issuer’s credit rating or other adverse news about an issuer can reduce the market value of that issuer’s securities. When interest rates rise, the market value of these bonds will decline, and vice versa. U.S. Treasury securities are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return and guaranteed principal value. The yield curve is a graphic depiction of the relationship between the yield on bonds of the same credit quality but different maturities. Chris Bailey is with Raymond James Investment Services. Material prepared by Raymond James for use by its advisors.

Securities offered through Raymond James Financial Services, Inc., member FINRA/SIPC.

© 2019 Raymond James Financial Services, Inc., member FINRA/SIPC. Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc.