Globally, billions remain at home under some variation of COVID-related lockdowns and social distancing, a phrase many of us hadn’t heard or used up until this year. Unsurprisingly, this has affected just about every industry, from restaurants to airlines to the oil industry. The markets, in turn, have experienced some turmoil although they perked up a bit in April on news of a potential therapeutic and unprecedented stimulus out of Washington.

You can get more on fiscal policy, the market’s reactions and what lawmakers plan to do next in the full market letter. In the meantime, we thought we’d share a few key points.

- Oil demand dropped precipitously in April, prompting prices to briefly turn negative for the first time in history. It will be some time before prices rebound.

- There’s no timeline yet for reopening the economy although some states have begun to dip their toes into the water.

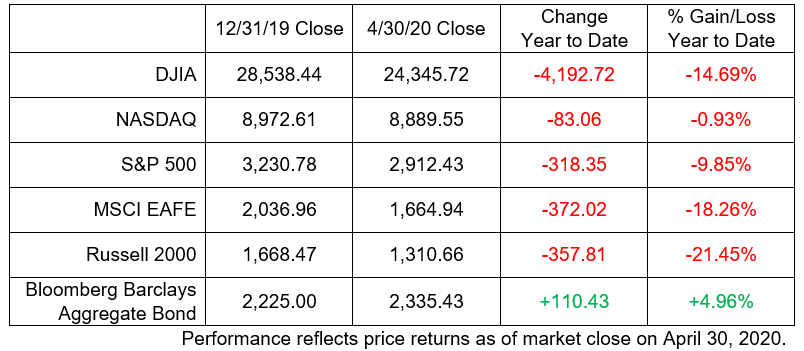

- Despite disruptions, stocks have continued to push higher, although they haven’t yet made up for the deep losses seen in March.

We know life may feel very different from “business as usual” these days, but we hope you take some comfort in knowing your financial plan was tailored to your risk tolerance and ability to handle market volatility. Know, too, that we are thinking of you and your family and wishing you all good health.

Investing involves risk, and investors may incur a profit or a loss. All expressions of opinion reflect the judgment of Raymond James and are subject to change. Economic and market conditions are subject to change. The Dow Jones Industrial Average is an unmanaged index of 30 widely held stocks. The NASDAQ Composite Index is an unmanaged index of all common stocks listed on the NASDAQ National Stock Market. The S&P 500 is an unmanaged index of 500 widely held stocks. The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. The Russell 2000 is an unmanaged index of small cap securities. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. An investment cannot be made in these indexes. Investing in the energy sector involves risks including the possible loss of capital, and is not suitable for all investors. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Chris Bailey is with Raymond James Investment Services, an affiliate of Raymond James & Associates, Inc. and Raymond James Financial Services, Inc. Material prepared by Raymond James for use by its advisors.

Securities offered through Raymond James Financial Services, Inc., member FINRA/SIPC.

© 2020 Raymond James Financial Services, Inc., member FINRA/SIPC. Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc.