The equity market hit a year-to-date high in June but was tempered by emerging coronavirus cases as states slackened their isolation orders, ending with a near flat month after three months of sustained rebound from the March 23 low.

The COVID-19 pandemic continues to drive fiscal and monetary policy, and as Federal Reserve Chairman Jerome Powell has said he expects the central bank to continue its support, Congress may soon start negotiating another round of fiscal stimulus.

As the results of loosening restrictions play out, investors should expect some volatility as new cases arise and states respond by pausing or stepping back their phased approaches.

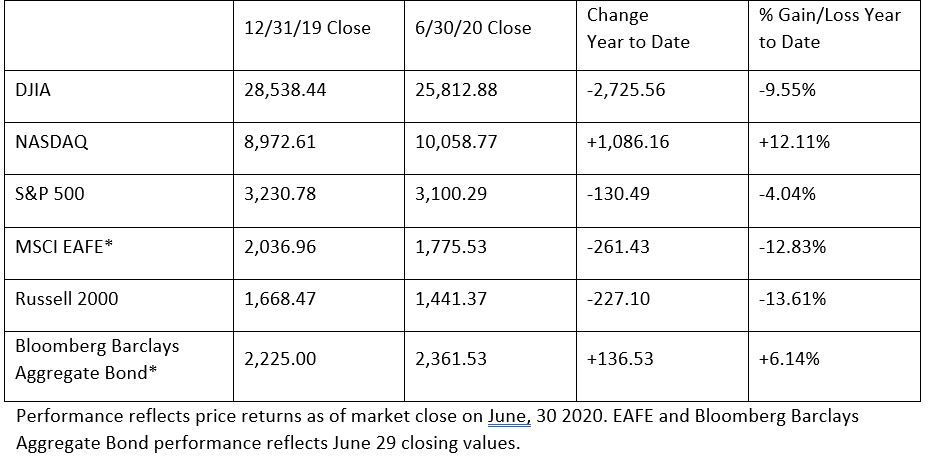

Currently, the state of the equity markets appears to be in two parts: tech and everyone else. Much of the growth of the equity market has been on the strength of technology stocks, which continue to see gains where other industries have experienced downward pressure and disruption to their markets.

We thought we’d share a high-level summary for now, but you can always read the full market letter for more details on the latest economic data and U.S.-China relations and how they may be impacted by the presidential election.

- June marks the first month since March where equity markets haven’t closed meaningfully higher than where they opened. As states ended lockdown restrictions, a rapid increase in COVID-19 cases weighed on stocks as phased reopening plans have been paused or called into question in some areas.

- Continued support from monetary policymakers and a new round of fiscal stimulus could continue to blunt the worst economic effects of the pandemic.

- Volatility should be expected in the coming months as states emerge from lockdown, and then pause or step-back phases of their reopening plans.

We’ll continue to monitor changes and update you on our thoughts as we live and work through this historic era.

Investing involves risk, and investors may incur a profit or a loss. All expressions of opinion reflect the judgment of Raymond James and are subject to change. Economic and market conditions are subject to change. The Dow Jones Industrial Average is an unmanaged index of 30 widely held stocks. The NASDAQ Composite Index is an unmanaged index of all common stocks listed on the NASDAQ National Stock Market. The S&P 500 is an unmanaged index of 500 widely held stocks. The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. The Russell 2000 is an unmanaged index of small cap securities. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. An investment cannot be made in these indexes. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

Material prepared by Raymond James for use by its advisors.